![]()

If I had to reduce my principles on finances and money to a single expression, I’d put it this way: Where Your Money Goes is Where It Grows. Or to spin it more negatively, where your money goes might just be where it dies too.

Most American don’t take much interest in their money and finances, at least in terms of their savings. “Thirty-four percent of workers have no savings whatsoever; another 35 percent have less than $1,000; of the remaining 31 percent, less than half have more than $10,000. Among older workers between 50 and 55, the median savings is $8,000,” according to an article in Inc on retirement. The stark reality is that most Americans have little or no savings.

People should expect more out of their money. The idea is that if you don’t know where your money is and what you are doing with it, then it’s really hard to expect much of your money. If you spend all your money and never save or invest, then your money doesn’t really work for you. But if you spend less than you earn and invest as much as you can, then your money becomes a partner. Your money begets more money.

Obviously different people have different life situations, but I believe everyone should strive for some form of financial security. That translates to savings. If you are following some basic common sense principles of personal finance, which we covered in a previous post, then you know that you should spend less than you earn, avoid (or pay down) debt, save, and invest in a diversified, low cost portfolio.

The gap I see in these simple principles is developing an awareness of your money, by which I mean tracking your money and having a budget.

For me, the answer to most things I’m trying to figure out is tracking it. I’m admittedly a pretty obsessive tracker, including time, productivity and health. Finances is no different in the role of tracking. Fortunately, most of finances and banking have gone digital, and there is a plethora of really great tools and apps to help you track, budget, save and invest.

Doubly awesome, if you mostly are using digital payments and banks online, there is a good chance most of your tranaction history is already being tracked. You just need to take ownership over the data, process it, and then start to leverage it.

In this multipart series on personal finance tracking, we have been looking at the principles of good financial behavior, how to track your finances (current post), and how to set trackable goals for saving and investing.

In this post, I want to look at how to track your money. I strongly believe that tracking of your money can help you gain an awareness of where you money goes. Then with a bit of budgeting you can set targets and build towards your savings and investments.

In the first part, we will review several great tools to track your money. Some are completely passive, though you’ll need to occasionally recategorize certain transactions. Other tools require you to actively log each and every expense, which while taking more effort, carry the benefit of greater awareness. Good money tracking can even be and sometimes should be done in a spreadsheet too. So we will look at some basic ways to visualize your financial data using a spreadsheet or existing tools.

Ultimately, the goal of tracking your money, creating a budget, and establishing good habits is to help you reach your goals. With tracking you can position yourself for the next stage of your financial life: saving and investing (future topic).

Part 0: How to Track Your Money: The Executive Summary

![]()

- Everyone should track their money, since it makes you aware of your money, helps you create a budget, and allows you take appropriate actions to avoid mistakes, save and invest.

- A transaction is the main activity you are following when tracking your money.

- A transaction is when you pay to get something or are paid for selling, doing or owning something.

- Besides the amount and specific description, the most important part of money tracking is the category. A category is the grouping where that transaction falls, like groceries, travel, etc.

- For automated money tracking and transaction aggregation, try Mint.com or Personal Capital. Both services aggregate data from your various financial accounts and categorize transactions.

- For manual money tracking and budgeting, checkout Spendee or You Need a Budget (YNAB). Though they can also automatically integrate with your bank accounts, these tools are specifically built to help you to manually log transactions and create a budget.

- After tracking, logging or aggregating your transactions, the next step is to calculate how much you are currently spending in different categories. This is your current budget and should be divided into weekly and monthly.

- You can create your budget either by importing and visualizing your transactions in a spreadsheet application or using the tools included in your tracking and budgeting app.

- Once you know your current budget, you can create new target budget, which define your overall expenses, income, etc.

- Budget goals are limits to how much you want to spend in specific categories and is the most basic aspect to setting and following a budget.

- You need a budget to reach your financial objectives.

- Until you develop automatic habits, you probably also need to regularly check-in on your budget and transactions to ensure you are on-target.

- Setup notifications when you are over or close to your limits.

Part 1: How to Track Your Money: Tools and Techniques

Where Your Money Waits: Types of Accounts

Before digging into tracking, it’s important to note that there are a lot of places where you money might be. These include but not limited to:

- Cash

- Bank Accounts (savings, checking)

- Online Payment Systems (PayPal, Venmo, etc.)

- Credit Cards

- Investment Accounts

- Bitcoin and cryptocurrencies

Before you can start automating your tracking, you should have a simple list of every account you possess.

Whether it’s a paper notebook, simple spreadsheet, online tracker, or even a digital note in your note taking tool, write down the basic info on each account, and, for bonus points, go ahead and note how much money you have in each.

In my case, I keep a note in Evernote called “My Money” where I have a list of every financial account I have and have been documenting my process in financial literacy, investments and personal money tracking. These planner journals are a great way to deal with anything from finances to learning to work processes.

Transactions: Tracking Your (Digital) Money Movements

Now that you know where your money currently is, let’s look at transactions.

To put a technical definition on it, “a financial transaction is an agreement, or communication, carried out between a buyer and a seller to exchange an asset for payment.” But to simplify it, a transaction is when you pay to get something or are paid for selling, doing or owning something.

In terms of tracking, a transaction is the main activity or event you need to be aware of when it comes to your money.

NOTE: If you are mostly using credit and debit to make payments, then you most likely already have a digital record of your past transactions. If you do a lot of spending in cash, then you’ll need to a separate manual tracking, which we will look at in a later section.

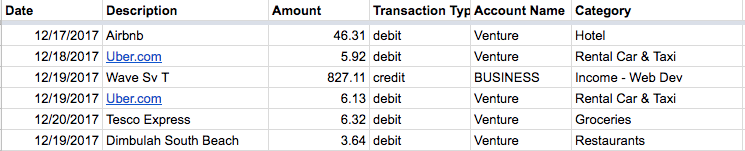

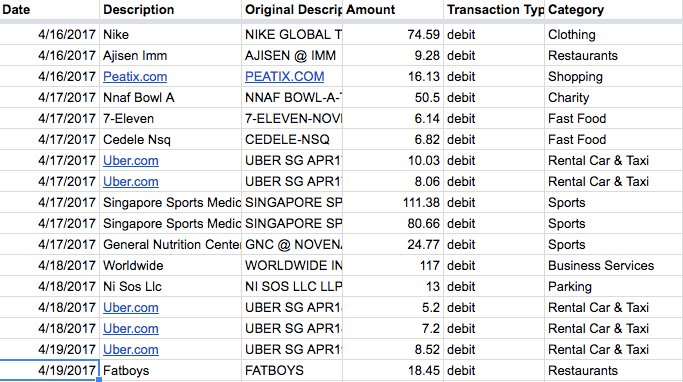

Here are some sample transactions:

As you can see it includes the date, description, amount, account type, transaction type and category.

There is both debit and credit. There are two types of transactions: income and deductions. Income or credit is the money you earn, and deductions or debit are the costs you have pay to for.

In the above example, I’ve also noted a category for each. A category is the general area that transaction falls into. Let’s look at that aspect now.

Categorizing Your Transactions: Most Important Step for Financial Hygiene

One of the most important activity you take when track your money is to categorize your transactions. Categories help you group your money and pick out patterns.

With categories, you are putting transactions into separate groups or “buckets” so you can understand that each of those areas separately and as a percentage of the whole. Categorized expenses is probably the most important aspect in creating a budget too.

Here are some sample general categories: Business Services, Restaurants, Health Insurance, Hotel, Air Travel, Cash & ATM, State Tax, Electronics & Software, Shopping, Groceries, Rental Car & Taxi, Clothing, Books, Entertainment, Alcohol & Bars, etc.

For most people these standard categories should work to get started, but if you have a noteworthy area, especially around your business, then it makes sense to create a few custom categories. For example, I have categories for server hosting since it’s a significant cost to my business and doesn’t directly fit in Business Services.

One of the most important activities for financial hygiene is categorizing your transactions. Only by noting the categories of every transaction you will be able to understand where your money goes. It may not be something you do daily, but it should be something you do every month or so. Otherwise it may take longer at the end of the year and you may not even remember what a past transaction was for.

Why Everyone Should Track Their Money

Now that we’ve covered types of accounts, transactions and transaction types, we are ready to get into the services to help you track your money. Everyone should be tracking their money. Why?

There are a lot of reasons to track your money. The most obvious is that if you don’t track your money, you might get changes you didn’t make. Tracking your money can help you save for something you want to buy or do and even help you prepare for retirement and not working. Tracking your money makes you aware of where you money is actually going and gives you a chance to make changes. Frankly though, financial tracking is something all healthy and financially wise person should do.

In the age of online backing and mobile tools, it’s incredible easy to do too. There are great options to track your money manually, automatically aggregate your digital truncations or even use a combination.

Ultimately the end goal is to have a complete list of your transaction history with the date, amount and category. This can then be used to create a budget and develop specific spending and savings goals.

Option 1: Manual Money Tracking and Budgeting

Like other manual tracking project I’ve done like mood tracking, the main benefit of manual tracking your money is in this “noticing.” It’s a lot harder to just buy things in zombie mode when you have to log it. By being forced to log a transaction it gives you an opportunity to re-think buying that expensive deluxe latte or frivolous purchase.

Once you have a budget, in some ways using cash and manually tracking your money can be a good way to build discipline and ensure you meet your goals. You know what you should and shouldn’t spend money on and logging your transactions removes any ambiguity on responsibility.

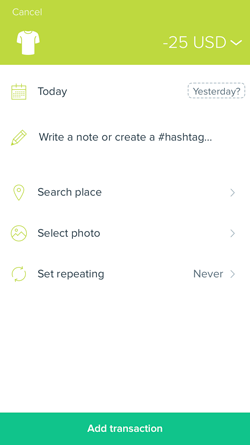

While the majority of the tech we are looking at in this post are for automated financial tracking tools, there are a number of great ways to track your money manually. Two I can recommend are Spendee and You Need a Budget (YNAB). Spendee in particular is a well-designed mobile app for money tracking. It also includes automated account aggression, so you can get the best of both worlds: manual tracking for cash and automated tracking for digital payments.

Logging your transactions is simple: select the category, enter the amount, and description. As you add more transactions, you can then view a breakdown of your expenses by category.

Option 2: Tracking Your Money with Online Banks and a Spreadsheet

The easiest way to track your money is to use digital payments, since it means all your transactions are digital too.

For some, the first place to start might be with your primary bank account. Most banks are online now, so one way to track your money is to export your digital transactions from your bank and categorize and label them in a simple spreadsheet.

The main advantages of using a simple spreadsheet is privacy and ownership. Since you control the data and aren’t sharing it to other services, you don’t need to worry about where you data goes or who it gets shared with. Similarly since you are exporting and categorizing transactions yourself, you have complete ownership and transparency.

The downside of this method is quite manual and can be a bit time consuming and not real-time or mobile. You have to export your transactions and categorize them one by one. In most cases you’ll need to this on a computer too. If you have a lot of accounts, this process can take even longer.

Like pure manual money tracking, categorizing your digital transactions can be a good step to helping you take ownership of your money is going. The physical act of going through your payments will tell you a lot about your behavior too and may even spur you to better financial habits in the future.

Unfortunately manually categorize your bank transactions can be a pain. Fortunately, there is a better way with online financial tracking tools!

Option 3: Tracking Your Money with Financial Aggregation Apps and Web Services

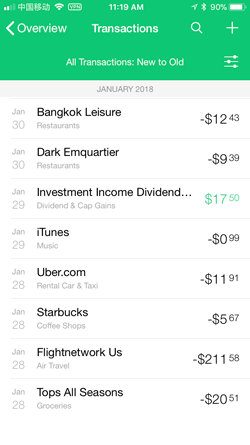

Whether you have a single bank account and credit card or a scattering of accounts, cards and services, several great financial services can aggregate all of your digital transactions together. Tools like Mint and Personal Capital aggregate your accounts and transactions history into a single system.

This allows you to see your total money across accounts, track transactions globally, create a budget and see your financial changes over time.

The main features that financial management tools provide are aggregation, categorization, and budgeting. These tools pull together all of your accounts into one place. They then make it easy to categorize expenses and incomes, and in many cases, they can categorize transactions automatically for you. Finally, these tools make it possible to see your income and expense trends broken down by categories. Knowing what you earn and spent in different areas is the first step in creating a budget, and these tools make it easy. Once you have a budget, you can even set goals and receive warnings if you are over.

Traditionally financial tracking was done with accountant software like QuickBooks, and many people continue to use this kind of software. Many accounting products have gone online like FreshBooks and Wave. This makes it possible to bill clients, track expenses and understand your company’s financial books. Most of these products weren’t a great fit for individuals thought.

One of the first tools to provide these features for everyday people was Mint.com. I’ve been a long-time user and fan of Mint. It was a game changer when I first started using it. All my accounts were brought together, many of my transaction were automatically categorized, and I always had a clear overview of my money situation (with charts!). All of my financial data was at my fingertips and mobile. As much as I am a spreadsheet and data analysis junkie, Mint made managing expenses much, much easier.

Increasingly, there are great alternatives to Mint including Personal Capital, Quicken and EveryDollar. You Need a Budget and Spendee also provide a level of digital transaction aggregation too. Personal Capital is a noteworthy challenger to Mint, since it provides a more robust approach to investing and understanding your long-term finical goals.

At its core these products aggregate your financial accounts into a single place so it’s easier to manage and understand your money. From there you get help categorize your transactions, though you’ll want to go through it periodically to confirm things are categorize appropriately. Finally these tools provide charts and graphs to show your your current budget of income and expenses.

(Option 3a: Online Financial Aggregation + Spreadsheets: Between using a pure spreadsheet approach or pure online financial tool approach, there is a third hybrid option. That’s using a financial tool to aggregate and categorize. The export your transactions from there for my spreadsheet data analysis. Personally, that’s how I use Mint, which lets me aggregate all of my accounts and categorize my online transactions with their software. I then export my transactions into Google Sheets in order to better engage with the data and my financial behavior.)

Part 2: Stay Financially Healthy by Creating and Following a Budget

In Part 1, we looked at different places to put your money and tools to track your money, classify your transactions and the basic idea of making a budget. In this part, let’s go a bit more practical into the how-to of tracking your money. Specifically let’s look at how to create and follow a budget.

Why Create a Budget

After aggregating and categorizing your transactions, the next step is to calculate how much you are currently spending overall and in different categories. That’s basically all a budget is a calculation of your expenses and incomes divided into categories over certain time periods, like weekly and monthly.

While the main reason to track your money is to gain awareness and collect all of your transaction history, the goal of a budget is slightly different. A budget is show you where you money is going in aggregate and provides goals so you don’t overspend and can save. Using your transaction data you can know your current budget and create a goal budget with specific spending and savings goals.

You might think you are frugal and “money smart,” but in reality, you need a budget to reach your financial objectives. Without a budget you really can’t know your spending behavior and tailor your goals to your situation.

Creating a Budget Using a Spreadsheet Application

![]()

Spreadsheet applications are great for initial data exploration and tracking. I use them all the time in my tracking experiments and even as the data source for most of my data visualizations. While it may not be real-time or as robust as targeted tools, the advantage of a spreadsheet is that you have control.

When it comes to creating your budget, a simple way to start is by exporting your transactions from your bank or aggregator tool and then importing them in a spreadsheet application. From there it’s relatively straightforward to create some reports and visualizations. You can start by creation various charts that do simple breakdowns.

Tip: Use Pivot Tables: While it’s possible to directly create charts on the raw data, I recommend first creating pivot tables. Pivot tables initially aggregate your data and provide ways to sub-divide data accordingly. A simple pivot table will aggregate and tabulate your transactions, which you can then chart and visualize. The main benefit is you have the tabular report along with the chart to visualize it.

![]()

Building a Budget with a Financial Tracking Tool

The same tools, websites and apps, which help you aggregate and process your transactions, can help you to create a budget too. Tools like Mint, Personal Capital, YNAB and Spendee take your logged transactions and convert them into your spending behaviors. These are then usually displayed as pie charts, which breakdown your spending habits by categories, and bar charts, which visualize your total spending and income per month.

Here are two examples from Mint and Spendee:

![]()

With these tools it’s quite easy to know your spending history and current budget, it’s also quite easy to see the biggest areas where you budget might be tweaked according to your goals. Let’s look at a few ways to think about your budget.

Questions to Ask Yourself: Do I Really Need a Budget?

While these charts and graphs make it easy to see your current budget, it helps to ask a few questions yourself.

The first question you need to ask yourself is this: Are my expenses exceeding my income? If they are then, you need to budget and sooner rather than later. Consumer debt like credit cards is one of the more precarious financial situations to find yourself in. So first make sure you are spending within your limit.

These next questions can help you to find opportunities to save more:

- Big Stuff vs Little Stuff: Are you spending more on cumulative little costs or more on big ticket items?

- Food Costs: Groceries vs. Everything Else (Eating Out, Snacks, etc.): Food expenses are one of the easiest areas to adjust your spending. So ask yourself: How much are you spending on food? How much on restaurants compared to groceries?

- Transportation: How much of your monthly budget goes to your car or other form of transportation? Is it possible to change how you get to work or the type of car you own in order to be more economical?

- Entertainment: How much are you spending on bars, video games, movies, music, concerts, etc? While these are great ways to spend your time, adjusting your entertainment spending periodically can help you save for a vacation or cut down debt, etc. So it’s look at what you are spending on entertainment and ask yourself, is the cost worth it?

- Subscriptions: How many subscriptions do you have? Are you using them all regularly? If not, consider canceling them or finding a cheaper alternative.

These are just a few questions I ask myself. I highly recommend finding your own questions and examining your own data to be sure your money is going where it works best for you. The target is to find areas where you can cut costs so you can save more.

Setting Goals: What Your Total Budget and Categorical Limits?

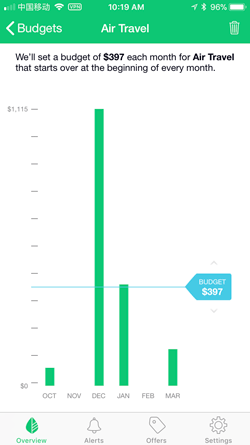

Setting and following budget goals is the most basic aspect of following a budget. Budget goals are limits to how much you want to spend in specific categories. Once you know your current budget, you can create new budget goals.

There are basically two parts to creating a budget: First, you set an overall goal for your total budget, and second, you set specific categorical limits.

With tools like Mint and others, it’s easy to create these goals. I especially like Mint because it provides contextual guide using past history to help you set these goals. You know where your past transactions tended to fall so you can set a reasonable goal.

Until you develop automatic habits, you probably also need to regularly check-in on your budget and transactions to ensure you are on-target. This might be something you do weekly or once a month, but I find it helps with any tracking to check your status and use your tracking history to know if you are on-target or not.

One tip with your budget is to setup notifications that warn you when you are over or close to your limits. These can be notifications on your phone or via email, and they can help you stay within your budget.

Conclusion: Practical Lessons from Tracking Your Money

Everyone needs to take smart decisions and consistent actions about their money, since good money habits trump occasional money luck.

In this post, we looked at financial tracking with a focus on tracking your spending transaction. Increasingly most buying and selling is done digitally. This makes it easy to either your spending with your online back or using various financial aggregators. Ultimately these tools help you first categorize your spending and second create a budget. Using budget goals and limits, you can start understanding your income and spending trends, and, in turn, set goals so you can save and invest. While self-trackers most think about their health and productivity, financial tracking is probably one of the most important things we all should do too.

Typically, in most self-tracking projects, there are two stages. There is the first stage where you choose tools and collect data to get a baseline. Once you understand what you are doing, you implement a change or establish a routine. The second stage is where your pursue your targeted habit or goal using tracking to get feedback and gauge your progress. Tracking data services is used as a check-in to see if you are on-target.

This is the same approach I recommend for money tracking. First, take the time to collect your financial data and process it to establish a baseline. This would be your current budget. This could take some time depending on how extensive your transaction history is and how far back you want to look. Take your time and “eat this frog” in several servings, since until you have a clean financial history, it’s impossible to come up with an accurate budget.

Once you have everything categorized, look at a few different charts and visualizations on where your money went. Understand your behavior and trends. Ask yourself various questions about where your money is going, if you that’s necessary or ideal for you, and if you could make adjustments to help you save more.

Now that you know your current budget, you can start to figure out what your goals are. For example, it might be to reduce your debt, shift your spending habits, save for a trip or save more for retirement. Once your have decided on what changes you want to make, you can use financial tracking to ensure you are following through and hitting your budget.

Personally, I believe the most important rule of good health is controlling what you control. When it comes to finances that means controlling your costs. I subscribe to a rather minimalistic lifestyle. While I do own a house, I don’t own a car. I don’t buy a ton of stuff, but instead I spend my money on experiences, like travel, books, etc., and on things that help me be more productive, healthier, and happier.

My overarching focus is keeping my costs and spending low and saving as much as I can. It boils down to this: When I make more, I save more; when I make less, I still can save something. While I may work forever, I still want to be ready to retire when I can. For me tracking helps make this happen.

Hopefully by tracking your finances, you too can better understand your money and reach your financial goals.

Best of luck and happy tracking!